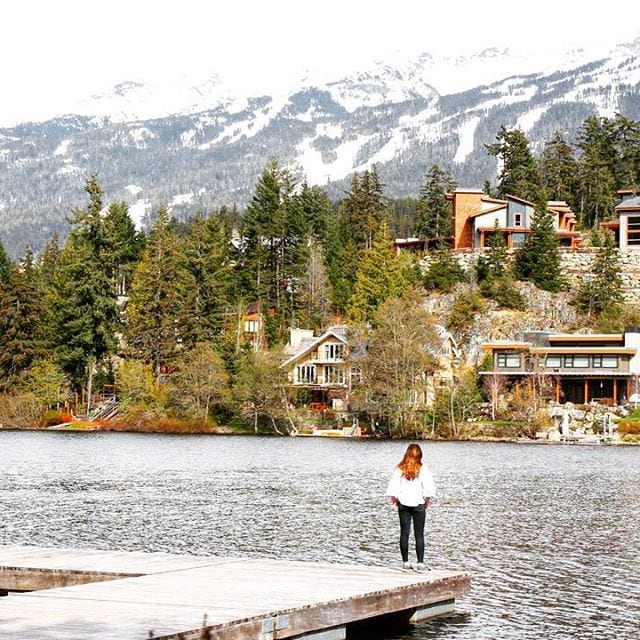

10 essential tips for how you can save for a vacation on a tight budget!

The current cost of living crisis has left a lot of people out of pocket. Job losses and smaller companies closing down paint a pretty bleak picture for the future of the travel industry. And as a result, I think people won’t be prioritizing travel anymore.

Fair enough, travel is a luxury it’s not a necessity like rent, food, and bills. But, if you’re like me and you can’t fathom a future without a vacation. Then, I’ve come up with some ideas on how you can effectively save for your vacation on a tight budget. I’ve tried all these tips myself, so they’re tried, tested, and proven effective. My husband and I have traveled to over 47 countries through effective budgeting.

Actually, many travel experts believe that travel will become cheaper as a result of the cost of living crisis, at least in the beginning. In an attempt to win customers, prices will be low to entice them.

However, if in the past, you preferred staying at smaller hotels, and booking tours run by locals, then, expect your vacation to be a lot different in the next couple of years. Sadly, a lot of small travel businesses will not survive. So, expect to vacation with the big-name travel companies. Companies like Hilton, Accor, Marriott hotel groups, and big-name airlines.

So, without further hesitation, here are 10 foolproof ways you can save for a vacation on a tight budget.

1. Make a savings plan and stick to it no matter what

Be ruthless with your savings, to do this you need to track your expenses. Put a day aside to go through all your bank accounts, bills, and other outgoing costs and see where you can reduce or even eliminate certain spending. Look at where you need to be – do you need to cut back on certain bills? Can you consolidate your credit card debt? Changing your spending and budgeting habits will take time so don’t be too hard on yourself.

Stephmylife Travel has a fantastic saving plan that really works.

2. Say goodbye to takeaways, takeout coffees and dining out

If you love your coffee like me, then why not invest in a good coffee machine? So that you can make those barista-style coffees at home. Sure, the initial cost of the coffee machine will be expensive, but if you think of how much use you will get from it as well as how much you will be using it. I’m sure it will work out a lot cheaper than your couple of takeaway coffees a week.

Why not get out your reusable coffee cup, put your homemade coffee in it, and go for a walk? Voila – feels like a takeaway coffee (kind of).

If you really can’t live without dining out a few times a month. Then, we love Meerkat meals (available in UK and Northern Ireland only). You can download the Meerkat app to your phone, to enjoy 2-for-1 on starters, mains, and desserts, every Sunday – Thursday at participating restaurants in your area.

First Table app, where you book the first table of the night at participating restaurants and get 50% off your food bill is a great tool too. It is currently available in New Zealand, Australia, Bali, the UK, Ireland, and Canada with more countries and cities in the pipeline

3. Stop buying unnecessary items

Can you do your supermarket shop online – to avoid impulse buying? I’m terrible for impulse buying – I see a cheap deal or raid the clearance stand and end up with lots of really cheap stuff that I just don’t need. Avoid clothing and beauty stores altogether – again, browsing usually equals unnecessary purchases.

Swap your preferred bottle of wine for a cheaper version, and switch to home-brand food products – all small steps now that will mean greater savings in a couple of months time.

Unsubscribe from emails that may tempt you to purchase unnecessary items. I’ve unsubscribed from websites like Asos, Net a Porter, etc. because I don’t have much self-control around fashion!

4. Pay with cash

Studies have shown that people are more emotionally attached to cash. This is because you can literally see it dwindling before your eyes. Whereas with a credit card, it’s all too easy to tap and go and look at your bank balance later.

After you’ve made your savings plan allocate a weekly amount of money you can take out as cash to spend on entertainment, dining, and other non-essential items. As we have seen, you will be more likely to consider that impulse purchase when you have to pay cash.

5. Put your money in a savings account, and don’t access it

I do this on every pay cheque – I transfer a set amount every two weeks into my savings account. And I don’t touch it. But I’m also realistic with the amount I transfer so that I don’t have to dip into my savings ever.

6. Set a target for your vacation and break it down into monthly installments

They say a goal without a plan is just a dream, and that is 100% true for saving money. You can’t just pick a savings goal and hope you achieve it. You have to have a realistic savings goal and plan for how you’re going to get there. You need to set a realistic budget for your trip.

This budget will massively depend on where you are going. A two week vacation to Europe is going to require a lot less savings than say a year backpacking the world.

For example for us, for a year of backpacking, we will limit our spending to $50 USD per person per day. This is to include everything – accommodation, food and transport. We’ll go under this daily budget in cheaper countries like Vietnam and Thailand but likely go over budget in countries like New Zealand and Australia.

Therefore, $50 x 365 = $18,000 USD so that means we’re going to need approximately that amount for a full year of travel! Of course, you can do it for less than this but you will need to limit your travel to cheaper areas like South East Asia and El Salvador in Central America.

The same method applies to your two-week vacation. Say, you budget $150 USD a day for a nice two-week vacation abroad. Again this is to include all costs – accommodation, dining expenses, etc. Thus, $150 x 14 =$2,100 USD. This is the minimum amount you need to save for your vacation.

7. Do your research to find out how much your vacation should cost

Use Google Flights to see the cheapest flight options over your dates. For your hotel – there are many ways to get cheap deals. Have you tried booking a Mystery Hotel deal before? Use Roomer – here you can buy discounted hotel rooms for a fraction of the price it should cost.

Travel during the off-season if you can – this is when prices are significantly cheaper and the crowds are thinner. Sounds perfect right? Basically, what I’m saying is to avoid school vacation season if at all possible. September/ October are ideal months to visit Europe because the weather is still warm but the peak Summer crowds have left meaning hotel rooms and flights are significantly cheaper.

Use Groupon or other similar websites to save on your activities whilst on vacation.

8. Holiday within your means

Sure, a luxury safari to Serengeti sounds wonderful. But if you can’t afford it, there’s no point in considering it, despite how amazing it may sound. If you’re on a tight budget, my recommendation is to stay as local as possible to save on expensive airfares.

From Europe, countries like Greece, Spain, and Portugal are beautiful and cheap travel destinations for you to consider. From the USA, a vacation to the Caribbean or another state is a safe bet to save money.

To save money on dining out, why not consider renting a unit with a kitchen so that you can cook some meals yourself? For drinks – have pre-drinks in your hotel room or apartment and then chase the happy hours so that you don’t end up spending too much money.

Suncream is notoriously more expensive in warmer countries – so be sure to bring this with you.

9. If you own your property, can you rent it out whilst you’re away?

- Booking.com or Airbnb are a great way to make additional income, whilst you’re abroad. Especially if you’re considering being on vacation for two weeks or more.

- Another good option is home exchanging. As seen in The Holiday, it can be a great way to see a new place through the eyes of a local plus it’s free accommodation essentially.

- If you’re renting – can you rent out a spare room to save rent $$$. Or, even more drastic – move in with your parents temporarily to save money.

- You can also earn money by renting out your car whilst you are away. Websites like Get Around will help you do this, their service fee is 25%. If you have a second car that you don’t use regularly you could rent this out throughout the year to top up your savings.

10. Live below your means and save the rest

It’s not always easy to save for a vacation on a tight budget. I know this. It may take some people longer than others to reach their savings goal. Try to consider this when you’re making your savings plan. All it takes to be successful is planning and the willingness to cut back on some expenses and be more cautious with your spending habits.

What are the ways you save for a vacation on a tight budget?

Why not read next –

6 ways to save money for travel

Excuses you’re using not to travel and how to overcome them

Like this post? Please PIN IT for later!

Last Updated on June 8, 2024 by snaphappytravel

3 thoughts on “How to Save For a Vacation on a Tight Budget”

I loved this post, it gives you something to work towards. Like you, I transfer money every month into a savings account that I can’t access easily.

I agree with saying goodbye to takeout and expensive coffee! It really adds up over the course of a month or so and people don’t even realise it! That’s money that could go towards a flight or a nice meal on vacation 🙂

Great tips! Very timely post. I’ll be on a tighter budget than ever before. Holiday within your means is so important. Thanks!